Skipton variable rates

The circumstances currently prevailing are no longer exceptional under each of two separate tests, which have been defined by the Society Board as follows:

Fraudsters are encouraging savers to move their money into higher risk cryptocurrency investments. Skipton does not endorse any cryptocurrency investments.

Be cautious of uninvited investment offers. If something doesn’t feel right, trust your instincts and take the time to investigate.

The circumstances currently prevailing are no longer exceptional under each of two separate tests, which have been defined by the Society Board as follows:

| Current Level | Threshold | Status | |

|---|---|---|---|

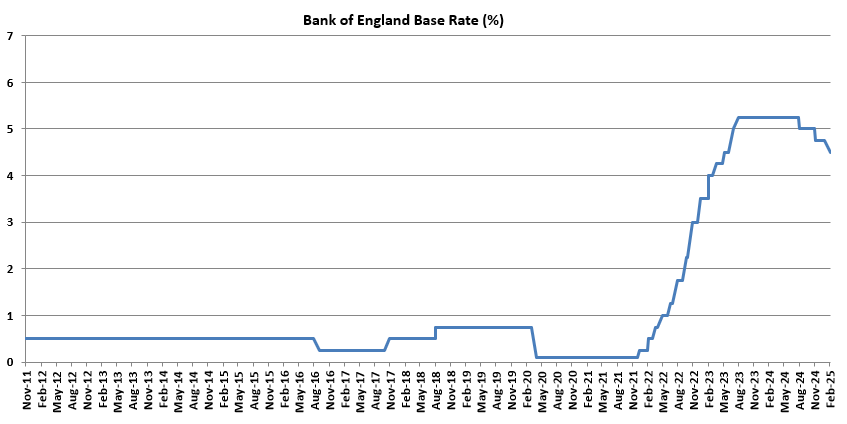

| Bank of England Base Rate (last changed 06/02/2025) | 4.50% | 2.70% | Exceptional circumstances no longer prevail |

| Latest | Status | |

|---|---|---|

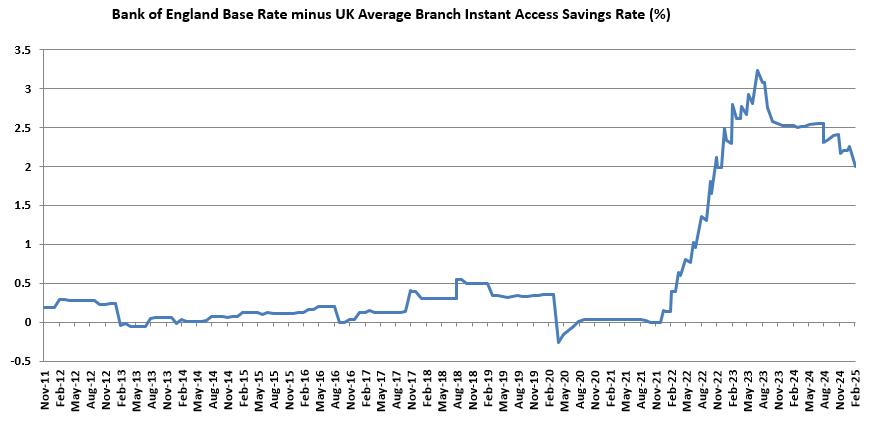

| UK average Instant Access savings rate** | 2.35% | Exceptional circumstances no longer prevail |

| Bank of England Base Rate | 4.50% | |

| Difference between UK average Instant Access savings rate and Bank of England Base Rate | 2.15% |

** If you wish to look at historical data, visit the Bank of England website.

The circumstances would be exceptional if either of these tests are satisfied.

We promised to track the performance of these tests and exceptional circumstances do not currently prevail. We will voluntarily restore the ceiling on our residential and buy-to-let standard variable rates during the period exceptional circumstances no longer prevail.